About Us

TEAM ALPHA

Michael Fernandez

Founder – CEO

Michael graduated from The Citadel Military College in 2017 with a bachelor’s degree in finance. Before founding Alpha Equity Group, he served as a commercial analyst at Berkeley Capital Advisors, specializing in underwriting large shopping centers across the Southeast. He also spent two years as an internal sales broker at an asset management firm with $419.3B in assets under management, later transitioning to principal work in Upstate South Carolina. In less than four years, Michael has facilitated over $100 million in transactions, gaining invaluable experience in raw land development, ground-up projects, acquisitions across various asset types, and innovative deal structuring. He is dedicated to analyzing submarkets, building strategic partnerships, and uncovering solid risk-adjusted investment opportunities. Additionally, Michael co-owns Solid Ground SC, a concrete contracting company serving the Upstate. Outside of work, he prioritizes physical health and wellness, enjoying marathon running, hiking, and other outdoor activities. He lives in Greenville, SC, with his wife Valentina.

Christian O’Neal

Director of Capital Markets

Christian brings over six years of experience in real estate financial analysis and underwriting across various asset classes, from ground-up development to commercial acquisitions and everything in between. He launched his first investment company at just 20 years old, gaining invaluable insights while working with leaders in commercial real estate development, real estate law, and student housing leasing. In addition, Christian spearheaded the development of the Charleston Business Group, collaborating with established organizations, local leaders, and venues to attract over 200 entrepreneurs and business leaders to their inaugural event in 2021. He studied commercial real estate at the University of South Carolina, and shortly after graduating in 2020, he founded a syndication firm and co-led the acquisition of an apartment complex in Uptown Charlotte. Christian holds an inactive SC Broker's License, is a member of ULI, and serves on the advisory board for the USC Alumni Club in Charleston, SC. In his free time, he enjoys surfing, exploring nature, and promoting wellness with his friends and family.

Gabby Howard

DIRECTOR OF SPECIAL EVENTS AND RELATIONS

Gabby is a dedicated real estate professional who has made a significant impact in the Upstate since 2018. As the owner of a residential real estate team and an in-house marketing firm, Gabby brings a wealth of knowledge in business development. Holding a Business degree from Georgia Southern University with a focus in Entrepreneurship, she possesses the expertise and experience necessary to navigate the complexities of the real estate landscape. Her background also includes three years of experience as a team leader and event planner for a local nonprofit organization, further refining her skills in project management and execution. Gabby is passionate about creating beautiful spaces that not only enhance the city but also preserve its rich history. With her keen eye for design, she is adept at envisioning and bringing projects at AEG to life. In her spare time, you may find her exploring Greenville's newest restaurants. Gabby also has a love for quality coffee, non-fiction books and actively stays engaged in her church community.

Our Focus: Residential Investment & Development

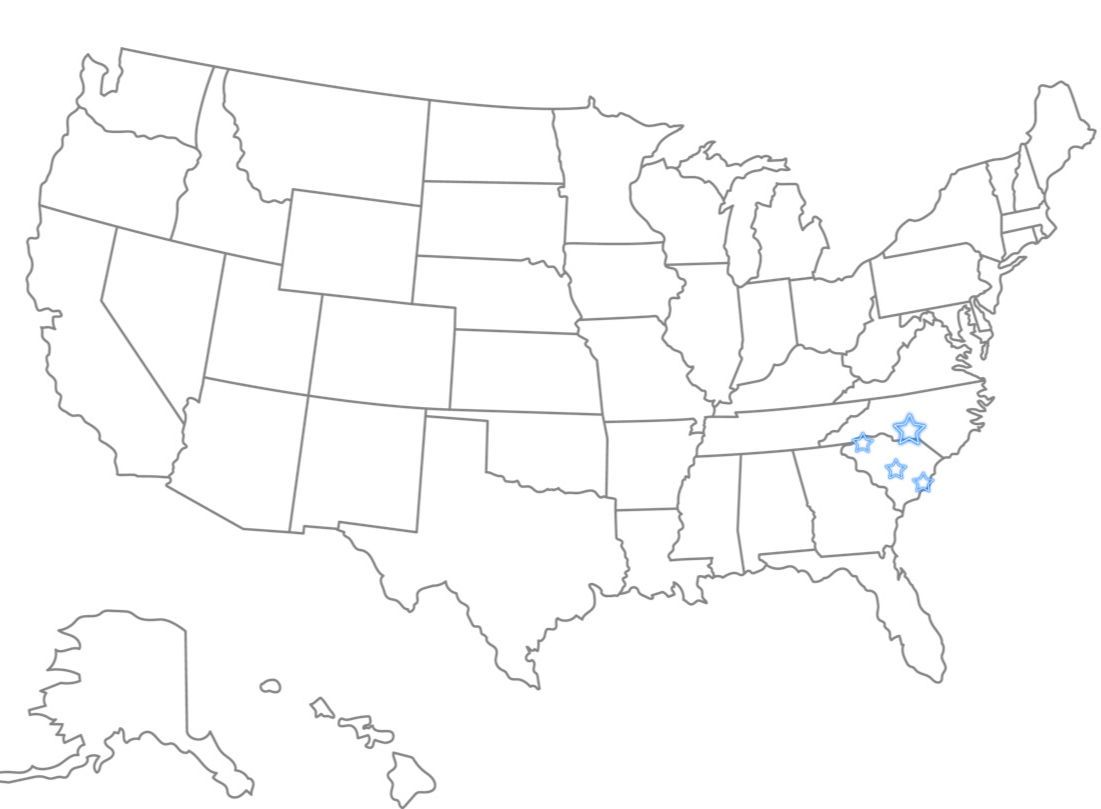

Residential housing in the United States is experiencing a material, structural shortage in the millions of units / year. We are exlusively focused on building, investing, and lending to thriving residential communities in the Southeastern United States.

Build for Sale | Build for Rent | Acquisitions

Vertical Building Integration | Strategic Partnerships

Land Development | Lot Development | Home Construction

Conservative Leverage| Ample Contingencies | Multiple Exit Structures

Development suitability depends on various qualitative factors such as environmental suitability, entitlement risk, topography, area demographics, and nearby supply. These factors serve as the inputs in our quantitative analysis. We quantify the full cost to develop with our strategic partners. We study and review the strength of absorption/demand for the end product, forecasted growth for micro location, and we determine if our projected profit margins warrant a full or partial development.

When market valuations fall near the replacement cost to develop new assets, we shift our focus to new acquisitions. Sometimes, that means looking far ahead and offloading deals prior to full development. If values are trending downward and challenge our required minimum margins, we will waste no time to move into healthier positions - even if that means moving to a different place of the capital stack, refinancing, or selling.

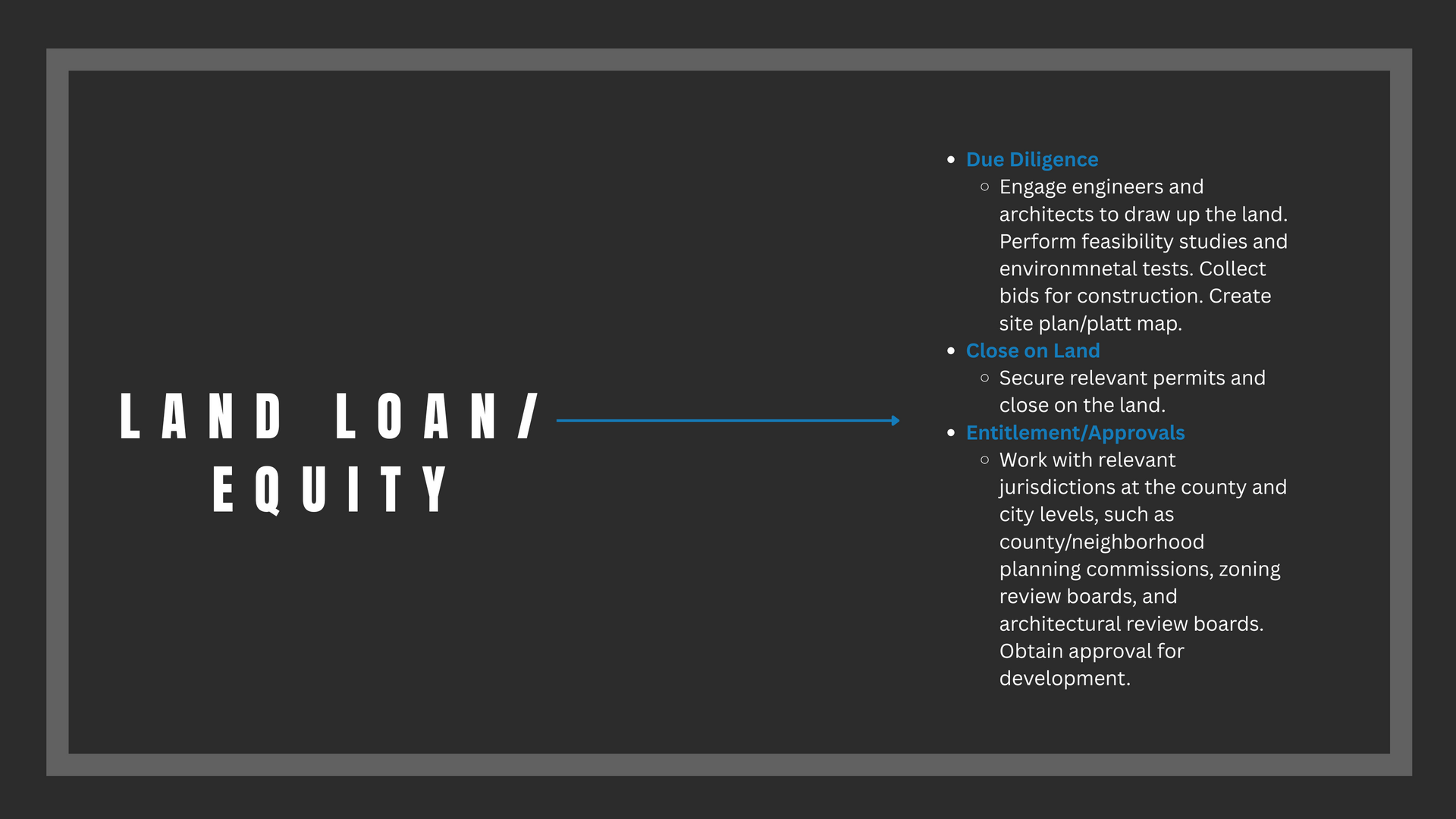

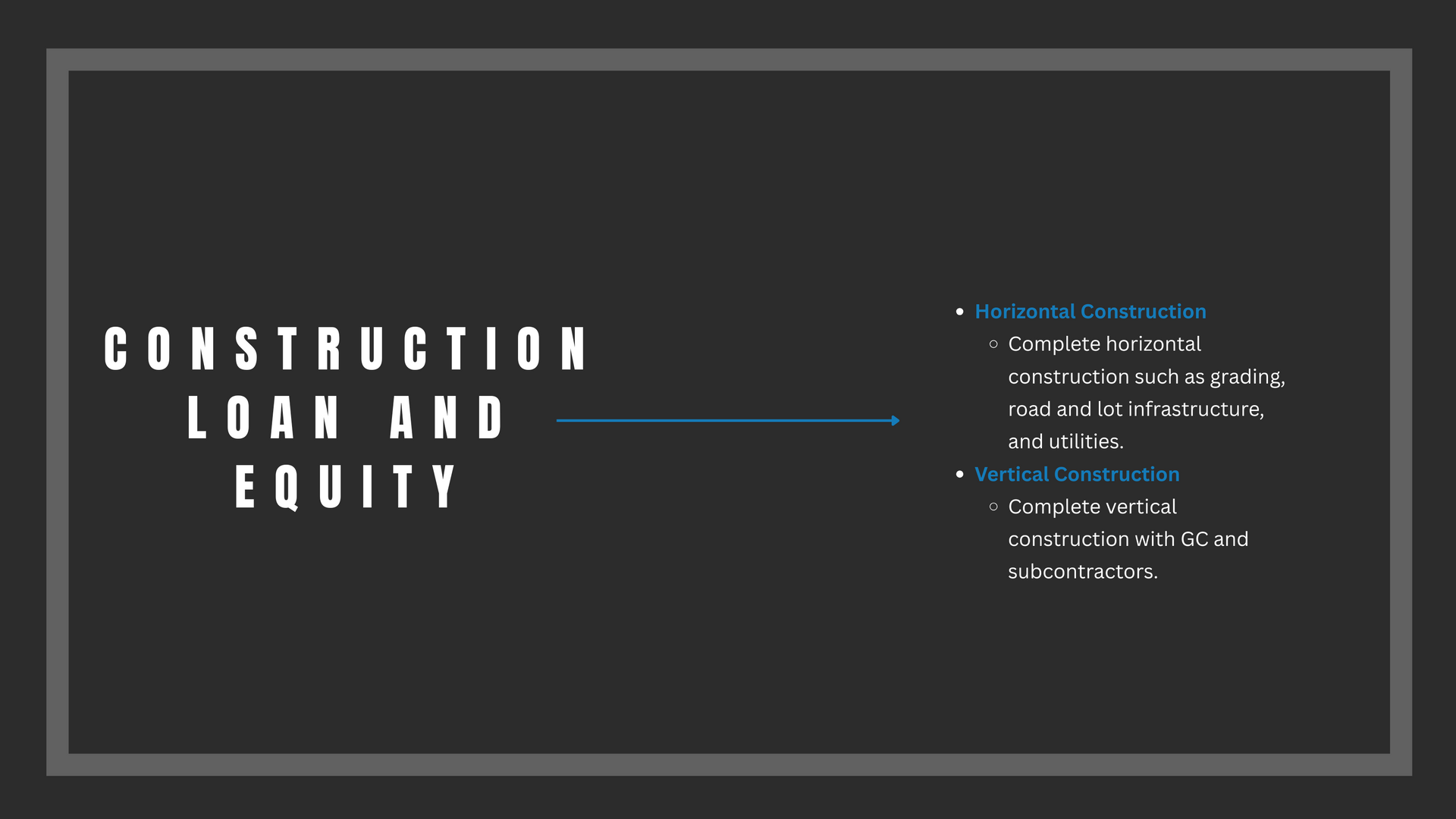

Development Scope - The Process

Our Differentiators

We invest across the capital stack in residential housing because we believe in a dynamic investment strategy that prioritizes safety first and growth second. We pay ultra close attention to mitigating risk through our financing terms / deal structures.

Investing Across the Capital Stack and Risk Spectrum

First Loss

Last Loss

Common Equity

Preferred Equity Mezzanine Debt

Senior Debt

Last Payment

First Payment

1. Common Equity

Last position to earn returns, first position to lose capital, unlimited upside return potential, limited to no control rights

2. Pref Equity / Mezz Debt

Includes preferred equity and mezzanine debt. Second to earn returns, second position to lose, capped total returns, limited control and default remedy rights

3. Senior Debt

First position to earn interest and receive original capital back, last to lose, total control and default remedy rights

We provide credit (debt) offerings as well as equity offerings to service investors who have different risk tolerances and goals for their capital. Everybody has unique financial and lifestyle circumstances, and we cater to those needs through our various opportunities.

During uncertain times, it often makes sense to invest lower in the capital stack to protect the downside risk of your investment. Debt investments are fundamentally more secure because in the event of borrower default, assets can be foreclosed on and resold. First position, senior loans are secured by mortgages or deeds of trust on property. Typically, values would have to fall greater than 25%+ for a debt investment to risk losing any original capital. Even then so, sponsors holding mortgages on property can hold & improve the assets until the market improves, preventing any need to 'firesale' the property for below-market value.

The correlation between the value of an asset and its underlying debt is strikingly low, protecting investors from value fluctuations in market downturns. During stable times, it can make most sense to invest in equity in search of high returns. Although equity takes the most risk, deal structure can significantly help reduce common equity's exposure to potential losses.

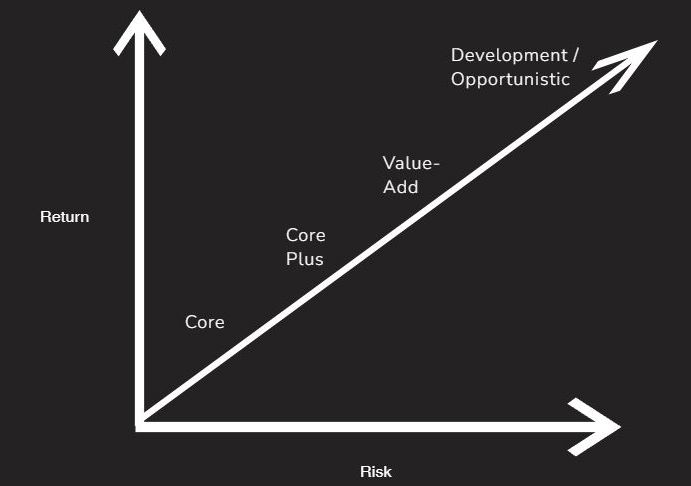

CRE Buckets of Risk and Return

Levered IRR Targets

6-9%

Investor Appetite

REITS, PE, LifeCos, Pensions, Endowments

Levered IRR Targets

9-13%

Investor Appetite

REITS, PE, LifeCos, Pensions, Endowments

Levered IRR Targets

13-18%

Investor Appetite

REITS, PE, Syndicators

Levered IRR Targets

18%-25%+

Investor Appetite

REITS, PE, Private Developers

In general, the commercial real estate industry agrees on four buckets of risk & return. Investors demand higher returns for higher risk deals. Conversely, investors accept lower returns for lower implied risk in deals. While there is a consensus for deal classification, there are blurred lines and overlap in strategies.

We employ safe, low return strategies when the market is volatile, and we look to position ourselves higher on the risk spectrum during stable times, when the reward warrants the risk.